PKN ORLEN (Baa3 / BBB-) - Inaugural Eurobond Transaction €500m 2.500% due 30 June 2021

On 23 June 2014, Polski Koncern Naftowy ORLEN Spolka Akcyjna ("PKN ORLEN“ or the “Company”), issued an inaugural EUR500m 2.500% Eurobond due June 2021. PKN ORLEN is one of the largest in Europe and highly integrated downstream company with diversified business model across segments and countries. Successful transformation and deleveraging in the past few years have resulted in investment grade ratings which enabled the Company to access the new funding market as a high grade European corporate. This strategic transaction is an outstanding result for PKN ORLEN achieving one of the lowest coupons among Polish issuers. The deal also represents the longest tenor for a non-sovereign Polish issuer so far in 2014. The final orderbook stood at EUR2.5bn from more than 230 orders - a testament to the overwhelming interest PKN ORLEN’s strong credit fundamentals.

Brief Termsheet

| Issuer |

Orlen Capital AB (publ) |

| Guarantor |

Polski Koncern Naftowy ORLEN Spółka Akcyjna ("PKN ORLEN") |

| Ratings |

Baa3(stable) by Moody's / BBB- (stable) by Fitch |

| Format |

Regulation S Bearer Notes, Senior Unsecured |

| Currency |

EUR |

| Issue Size |

EUR 500,000,000 |

| Pricing date |

23 June 2014 |

| Maturity date |

30 June 2021 |

| Coupon |

2.500% Annual, in arrears, on 30 June in each year |

| Re-offer Price |

99.135% |

| Re-offer Yield |

2.637% |

| Spread vs Benchmark Yield |

MS+160bps / DBR 3.25 Jul-21 + 188.9bp |

| Denominations |

€100,000 x €1,000 |

| Governing Law/Listing |

English / Irish Stock Exchange |

| HSBC role |

Global Coordinator, Active Bookrunner |

Key execution highlights

HSBC acted as a Joint Lead Manager and Bookrunner on the inaugural EUR500m 2.500% Eurobond issue due 30 June 2021 for PKN ORLEN S.A.

- This was a textbook example transaction executed towards clear timing milestones to achieve the shortest timetable for an inaugural corporate Eurobond offering,

- The two-team roadshow was announced on 12 June and took place between 16 and 18 June covering London and Continental Europe (Frankfurt, Munich, Amsterdam, Vienna, Zurich and Paris),

- Taking advantage of strong interest and momentum garnered from the investor meetings, PKN ORLEN officially opened the orderbook in the morning of Monday, 23 June,

- Initial Price Thoughts for a 7-year EUR benchmark transaction were released at 7yr EUR MS+ high 100s area. The issue generated high-quality demand at the outset as the orderbook was fully subscribed within 40 minutes of the IPT release,

- As the orderbook stood in excess of EUR1.5bn, the issuer leveraged strong demand from high quality investor base to announce the official guidance at MS+175bp area; shortly after noon UKT, when the book exceeded EUR2.5bn, the final guidance was revised to MS+160/165bp (to price in range),

- The transaction was finally priced at the tight end of the revised guidance with the re-offer yield of 2.637%. The deal achieved very granular orderbook in terms of geographic distribution with real money investors taking most of it.

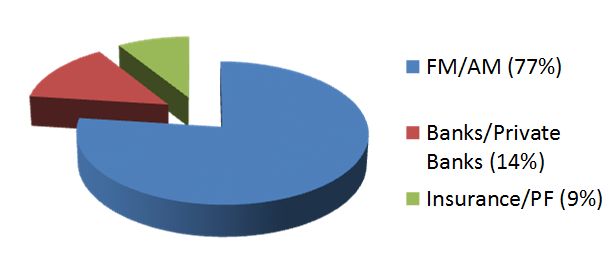

Distribution Statistics

Source:

HSBC Bank Plc, PKN ORLEN (Baa3 / BBB-) - Inaugural Eurobond Transaction €500m 2.500% due 30 June 2021.